Panelized Homes: The Next Big Thing for the Building Industry?.

Category Archives: Affordable Housing

“Questionable Spending” – from Capitol Hill to Rocky Top

There are always two sides to every story, and both sides rarely receive equal consideration when the story is told, most especially the way the story is told.

Such is the case with NewsChannel 5 Investigative Reporter Phil Williams’ relentless pursuit of one of the most efficient agency models in state government, the Tennessee Housing & Development Agency, or THDA for short.

The investigative reporter even suggests their motto “Leading Tennessee Home” should unofficially be the song “Girls Just Wanna Have Fun,” a humourous twist that got viewers and lawmakers’ attention, but certainly not the true picture of the agency, its employees, and accomplishments.

Former THDA Director Ted Fellman arrived at THDA in November 2005. His leadership transformed the agency from a beaurocratic behemoth to a well-oiled machine. I have been in Real Estate since 2000 and have observed the agency evolve first-hand.

What used to take weeks to process now is accomplished in 24 hours or less. The THDA staff gets the job done rather than “pass the buck” to someone else in another area, which we have all experienced in dealing with government agencies.

THDA employees take their job seriously and enjoy it. You will see them speaking at Rotary Clubs at 7:00 am as well as Realtor and other functions late in the evening. They believe in their organization. They believe in their mission. They produce results.

I know this not only from past experience, but from proudly serving on THDA’s Realtor Advisory Board. The agency is constantly reaching out to the public sector for input and ideas on how their organization can make an even larger difference in the lives of Tennesseans. In THDA offices, you can feel a spirit of cooperation and teamwork among everyone there.

Ted Fellman brought a culture to THDA that produced results. Experts agree that incorporating FUN into the workplace dramatically increases productivity.

CLICK HERE FOR DETAILS http://www.robinthompson.com/makingworkfun.htm

Instead of public ridicule from a TV station, Ted Fellman and the Staff of THDA deserve a sincere THANK YOU for becoming a nationwide model for effective housing finance agencies. If the rest of the country recognizes this, why can’t we? That’s the side of the story that needs to be told.

SEE MORE ABOUT RECENT THDA AWARD HERE http://tn-tennesseehda.civicplus.com/archives/41/NCSHA%20Awards.pdf

Moving forward, THDA Director Ralph Perrey needs everyone’s support. The agency has accomplished so much for Tennessee and its productiveness need not be hampered in any way from outside sources.

Moving forward, THDA Director Ralph Perrey needs everyone’s support. The agency has accomplished so much for Tennessee and its productiveness need not be hampered in any way from outside sources.

Even though THDA does not spend taxpayer dollars and derives its revenue from other sources, Phil Williams did bring attention to the fact that those dollars were public dollars, which is a very valid point.

The public dollars that were spent by THDA on team-building exercises and employee rewards actually increased productivity.

That said, let’s go to Knoxville and investigate the spending habits of the University of Tennessee, where the spending of public dollars has not increased productivity.

One doesn’t have to go far….a severance package of $5 million for a football coach, who knows how much severance for Assistant Coaches, etc. What about the salaries for the replacements? And what do they do for fun?

They will say they are not spending taxpayer dollars, but revenue generated from the “program.”

Just like THDA does, except no one is going to question a thing….ever. Not even Phil.

In response to allegations, THDA Director Ralph Perrey says the agency is only going to spend money on what make sense for its mission and eliminate anything questionable that lawmakers would not understand.

It would be much easier to eliminate what they do understand. Enough said.

Trey Lewis is a licensed Real Estate Broker in the State of Tennessee with Ole South Realty, 615.896.0019 direct 615.593.6340. Specializing in new home sales in the Greater Nashville area to include Nashville, Murfreesboro, Smyrna, Gallatin, Clarksville, and Spring Hill, Tennessee.

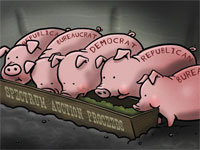

Election 2012: Its all about the trough.

The current political state of our country sickens me. Everyone just has to blame somebody. Thank goodness for George Bush. Without him, Democrats and Republicans alike would have no one to blame.

And they all say “after this election things will be different.” Everybody that runs for anything says it, and has been saying it for years. Now days, they simply make up facts as they go to substantiate their position. Why tell the truth when a good lie will do?

And we, the American Electorate, don’t seem to care. If we really did, things might change.

It is all about the trough.

Even the most sincere elected officials are corrupted by the trough. They arrive on the scene with the best of intentions. Then they see the trough. “If another state, or special interest group, is grazing at the trough..then mine should too.”

So, the candidate you should vote for is the one that will get the trough money to the one that will do YOU the most good. But first, think about a few key issues:

1) The MEGA-RICH people that actually have the ability to do whatever they want without consequence, will NOT pay any tax they do not want to pay. They have the ability to take their marbles and go home. They can shut down their factories and they can hoard their money. They don’t have to invest if they don’t want to. They can hunker down and ride out any storm without missing any cocktail parties.

2) The “rich” actually make affordable housing a reality for many families that would otherwise be homeless. Ever heard of the “Low Income Housing Tax Credit?” LIHTC for short. Read about it here.

3) The “rich” are also the ones that fund tax-free bonds that finance the homes that many families live in. In Tennessee, a family of 3+ with household income less than 92,680 can purchase a $275,000 home under down-payment assistance programs that these tax-free bonds make possible.

A QUESTION…..

Do we really want to close all of the tax loopholes that benefit the rich?

Most of us probably consider our employers “rich.” Do we really want government taking more from them, leaving less for them to invest in us?

I for one take great comfort knowing that my employer has more money than I do. If that weren’t the case, I would be very uncomfortable. Therefore, I am not for anything that would lessen his financial abilities.

One thing for certain, nothing substantial in government will ever change until we hide the trough, or quit refilling it!

Metro Property Tax Increase – The Double-Edged Sword

It costs a lot to run the “world class city” that Nashville has become and I don’t envy Mayor Karl Dean one bit! CLICK HERE to learn more about the Mayor’s proposed property tax increase.

Nashville businessman Lee Beaman contributed an interesting opinion with his letter-to-the-editor this past Sunday. CLICK HERE to read his opinion. (Please pay little attention to the class-envy comments that some made. We can be assured the Beaman family pays more than their fair share in taxes to Metro.)

Karl Dean is right. Nashville needs more revenue to continue and expand the services that we all demand and expect. New schools need to be built. Old school buildings are in disrepair. Metro employees need raises. Road improvements need to be scheduled. Our aging infrastructure needs to be replaced in many areas. We need more parks to add to our quality of life.

Most importantly, Nashville really needs a better and more boater-friendly Riverfront Park! The riverfront areas of Knoxville, Chattanooga, and even Clarksville beat ours.

Lee Beaman is right too. Increasing property taxes do make property values fall. Maybe not all at once, but they will fall. Look at Memphis and Shelby County.

So, the average Nashville family will pay $192 more per year. That $192 translates to approximately $3,000 in home purchase affordability. Those that barely qualify for the “$145,400 median home value” in Davidson County will now only qualify for approximately $142,400 under the new tax rates. Maybe not devastating, but enough to rattle the cup…especially when it may be yours!

The value of a piece of property is directly related to what a person or business can afford to pay for it. Then, the more the value falls, the more the tax rate has to go up to generate the same revenue. A vicious cycle.

What is the answer? There’s not a good one. No answer will be popular to everyone, but it really is time to think outside of the box.

The answer is simple. We need a larger property tax base. We need more families moving into Davidson County. We need more businesses locating within the county limits. We need people spending more money in Davidson County.

It all starts with affordable housing, balanced with quality of life, and convenience. Why wouldn’t someone working in Davidson County choose to live here? We have got to eliminate those reasons to begin solving the problems.

Our surrounding counties do not have a football stadium to support, yet their citizens enjoy it. They do not have the responsibility of a world-class arena, but their citizens pack it. None of those counties have an international airport to maintain. Some don’t have an airport at all!

Before you get the tomatoes, I am not advocating charging out-of-county residents more for airline flights, concerts, Titans, and Predator tickets. We need every seat filled that we can get! But it would be nice to have a “Metro Resident Discount.”

What about employers offering a “Metro Resident” pay incentive? That incentive could come from TDOT, who could then slow down interstate constructon projects a bit!

Then, if we could just make it less cumbersome for developers and builders to provide new, affordable housing in areas that already have needed infrastructure, we’d be off to a good start!

Nashville New Homes: The HBAMT Home Show – Don’t miss it!

You know Spring is just around the corner when it is time for the Home Builders Association of Middle Tennessee’s HOME SHOW. The event is being held at the Williamson County Agricultural Center and it is going on NOW through Sunday!

CLICK HERE for all the details.

Exhibitors began setting up their booths early Thursday morning and from what I saw then, this year’s show will be better than ever. Not only will new home builders (LIKE OLE SOUTH) be there, but you will also see the latest in home improvements and services!

Whether by choice or not, we are all spending more of our free time at home. Why not check out the latest trends in home enjoyment, especially outdoor living? You will be happy that you did.

And while you are there, drop by and see Ole South. Yes, you really can buy a $275,000 all brick home in Williamson County without making a down-payment! While you’re there, register with Annette Spicer to win a $100 Gift Card. Find out why thousands of Tennesseans are proud to say, “Ole South Built It.”

Trey Lewis is VP Sales & Marketing for Ole South Properties Inc, Tennessee’s largest independent home builder, 615.896.0019 direct 615.593.6340 or email TLewis@olesouth.com. Specializing in new homes in the Greater Nashville area to include Nashville, Murfreesboro, Smyrna, Clarksville, Gallatin, and Spring Hill, Tennessee.

Nashville New Homes: Get up to $11,000 from the government for your new home downpayment?

In Tennessee YOU CAN!

Qualified “first-time buyers” can receive downpayment assistance of 4% of the purchase price of a new home up to $275,000 in most counties surrounding Nashville! And in Maury County, you don’t even have to be a “first-time buyer!”

It gets even better…. A “first-time buyer” is defined as someone that has not owned a principal residence in the previous three years. Even if you have owned a home in the past three years, there are a few specialty loans available that only require a $500 down payment. Sure there are certain guidelines and limitations, but why not explore and see if any are right for you?

We’ve all been saying that NOW is the time to buy, and many just kept sitting on the fence. NOW was yesterday. You have lost out on the very BEST deals.

If you’re sitting on the fence in Middle Tennessee, its going to cost you even more to keep waiting! READ MORE HERE.

Don’t get me wrong, ALL of the best deals are not gone. But they are going fast.

I’ve always said “there is never a bad time to buy a home, but some times are certainly better than others.” The planets ARE lined up in Middle Tennessee and they point to the new homes we have to offer at www.OleSouth.com!

Don’t panic. Its still not too late to take advantage of the great deals out there on a new Ole South home. But if you want to use up to $11,000 in free government money for your down payment, you better not wait much longer!

Trey Lewis is VP Sales & Marketing for Ole South Properties Inc, Tennessee’s largest independent home builder, 615.896.0019 direct 615.593.6340 or email TLewis@olesouth.com. Specializing in new homes in the Greater Nashville area to include Nashville, Murfreesboro, Smyrna, Clarksville, Gallatin, and Spring Hill, Tennessee.

Nashville New Homes: The “Short Sale” can of worms.

I was showing one of our brand new Ole South homes this week to a first-time home buyer. They loved the home and all of its many features, especially the fact that everything was NEW and under warranty too.

They had learned through others that new homes offered the best value for the money, and that in most cases, a new home could be purchased for the same price, or even less, than an older resale home comparable in size and features. They had looked at other resales, and told me everything that was important to them, even the price range. Well guess what? We have the perfect home nearing completion!

This particular home was $169,990, complete with all appliances and closing costs paid. Using THDA’s Great Start program for first-time homebuyers, their monthly payment, yes PITI, would be approximately $1153 with zero cash out of pocket at closing. If they chose to place their own down-payment of approximately $5950, their monthly payment would drop to approximately $1076.

They really liked the -0- down option, but developed a perplexing look on their faces. They really wanted a NEW home, but there was another home, similar in size, just 2 miles away they had seen online. It was listed for $84,900. It was a “short sale.”

They asked, “Just what does that mean?” I explained the basic process where the bank would hopefully agree to allow the current owner to sell the home for less than the bank was owed on the property. “You mean to say the bank is going to let them sell that home for 84,900?” No, not necessarily. “Then why is it listed for that price?”

Great question. And we Realtors know the answer. It is just like fishing. We know the list price is just to attract a prospect, who will then be encouraged to make an offer, which the bank, at some unknown point in time, will accept or counter. We all know that in most cases, the bank will not approve a listing price on a pre-foreclosure home until an offer of some kind is on the table. The general public does NOT know that.

So, in the meantime, those shopping for homes receive a unrealistic picture of home values. Neighborhoods suffer. Those trying to sell their homes without financial difficulty suffer. Zillow’s “z-estimates” seem to pick up on the suffering too, lowering those home values that are automatically calculated. People believe those values because they saw it on “the internet.”

Okay, let’s go ahead and open the can of worms.

The “short sale” can be a great alternative to foreclosure and I know many Realtors that are very successful negotiating the sale of homes in this situation. It can be a win-win situation for all involved, but only if extraordinary levels of patience can be applied.

Let’s be serious. Wouldn’t our whole real estate economy be better off if a property could not be listed at an arbitrary price that is basically pulled out of the sky?

Many will disagree, but ANY home listed for sale on our MLS should be able to be purchased at the price listed. Period.

Why can’t our MLS require all short sales to be classified a separate way without a list price, followed by the instructions? Or, if a price has to be present, enter $1.00. At least that way, the playing field is more level. I know there are data fields already for short sale notations, but that still leaves the “pie-in-the-sky” listing price. Simply put, it is “bait and switch.”

Again, there are many great Realtors that specialize in “short sales.” If you would like a recommendation, please feel free to contact me anytime.

Bad things happen to good people all the time. If you know anyone that has suffered a 30% drop in income or more, that may need assistance in avoiding a foreclosure or short sale, don’t forget about THDA’s newest program, www.keepmytnhome.org.

And always remember, better times are ahead.

Trey Lewis is a licensed Real Estate Broker in the State of Tennessee with Ole South Realty, 615.896.0019 direct 615.593.6340. Specializing in new homes in the Greater Nashville area to include Nashville, Murfreesboro, Smyrna, Clarksville, and Spring Hill, Tennessee.

Nashville New Homes: Even lower mortgage interest rates? Coming soon.

That’s right. Even lower interest rates are on the horizon for first-time home buyers, thanks to the folks at Tennessee Housing Development Agency (THDA). Visit their website, www.THDA.org for more information.

Here are the new program rates that go into effect September 1, 2011 for all files submitted ON OR AFTER that date:

Great Rate – 3.95% For the first-time buyer that has their own down-payment funds and closing costs, if not paid by a seller. Perfect for those with front and/or back ratios below 45%.

Great Advantage – 4.25% Buyer receives a 2% grant that may be used toward down-payment, or closing costs if not being paid by seller

Great Start – 4.55% Buyer receives a 4% grant that may be used toward downpayment, admin fees, and closing costs if not paid by seller.

Remember! When you purchase a new home from Ole South in Nashville, Smyrna, Murfreesboro, or Spring Hill, and use Ole South Financial (our SunTrustMortgage Joint Venture), ALL CLOSING COSTS are paid! (note: certain conventional loans limit seller contributions to 3%)

YES! A first time buyer can purchase a brand new Ole South home with ZERO CASH DOWN AT CLOSING and receive a 4.55% fixed interest rate 30-year FHA loan. Find yours at www.OleSouth.com

NOW – an unprecedented time to take advantage of unprecedented opportunities.

Trey Lewis is a licensed Real Estate Broker in the State of Tennessee with Ole South Realty, 615.896.0019 direct 615.593.6340. Specializing in new homes in the Greater Nashville area to include Nashville, Murfreesboro, Smyrna, Clarksville, and Spring Hill, Tennessee

Nashville New Homes: Zero downpayment available to even more home buyers.

This morning, while reading Leneiva Head’s blog about THDA’s foreclosure prevention program, it hit me that I had forgotten to do something.

Yes, I had forgotten to post about some recent changes from the great folks at THDA, who are always on the forefront of ways to boost home ownership!

Everyone should know that down-payment funding for FHA loans is still available for eligible first-time buyers through THDA’s “Great Start” program. To be eligible, your household income cannot exceed certain limitations and the price of the home you are purchasing must fall below a certain amount.

On August 1st, the income limitations were raised! These revised limitations bring the reality of home ownership within the reach of many more first-time buyers.

Lets look at the Greater Nashville area, including the adjoining counties of Rutherford, Williamson, Sumner, Cheatham, Wilson, and Robertson: A first-time home buyer can purchase a home with ZERO out of pocket if the home price does not exceed $226,100. A buyer’s household gross annual income cannot exceed $79.440 for 1-2 person households. If the household contains 3 or more, annual gross income can be as high as $92,680.

For eligibility in nearby Maury County, the home purchase price cannot exceed $200,160, with gross income limited to $70,320 for 1-2 person and $82.040 for 3 or more person households. Maury County is a designated “target” county and you do not have to be a first-time buyer to take advantage of THDA programs.

Like with any loan program, there are additional credit score and debt ratio requirements for eligiblity. Visit www.thda.org for all the details.

If you are looking to purchase a new home, and like the idea of keeping your down-payment, you will want to explore this program. We have homes available right now in almost every community that can fit within the guidelines. Visit us today and find out why Ole South is Tennessee’s # Home Builder!

Trey Lewis is a licensed Real Estate Broker in the State of Tennessee with Ole South Realty, 615.896.0019 direct 615.593.6340. Specializing in new homes in the Greater Nashville area to include Nashville, Murfreesboro, Smyrna, Clarksville, and Spring Hill, Tennessee

Nashville New Homes: Through the eyes of a homebuyer

You know the saying, “can’t see the forest for the trees.” Yeah, that one. There is a lot of truth in that cliche, and the solution is to take a few steps back and view things from a different perspective.

This week, we’ve been filming new TV spots of our new homes and neighborhoods throughout the Greater Nashville area for Home Center Network. With pictures being worth a thousand words, a TV spot must be priceless, especially through the eyes of a new home buyer.

I’ve always known our new homes and neighborhoods in Nashville, Smyrna, Murfreesboro, Spring Hill, and Clarksville offer the best new home values in all of Middle Tennessee, but this week has opened my eyes to see way beyond that. They are also beautiful! And even more so, the closer you look.

From the “resort-lifestyle” offered in Puckett Station and Scottish Glen, to the charming craftsman styled homes of Evergreen Farms, Ole South offers something for everyone desiring a new home in Murfreesboro.

In Smyrna, the maintenance-free convenience of Lee Crossing townhomes are unmatched by any others. Our Belmont neighborhood is expanding into a new phase of homesites, in the best new school district of the area.

In Nashville/Davidson County, look no further than Ole South!

One of our most successful neighborhoods, Barnes Crossing, is almost sold out and completed, with only 6 homes under construction remaining. Close to Nippers Corner, Lenox Village, Brentwood/Cool Springs, and downtown Nashville, you will appreciate the affordable convenience of this community. Just around the corner, you will find Rivendell Woods of Cane Ridge, offering a great selection of traditional homes and town homes.

Preserve at Old Hickory offers a wide selection of traditional homes and also offers maintenance-free townhomes in the adjoining Old Hickory Commons. And we have special-purchase opportunities in the communities of Spencer Hill and Old Hickory Hills too! Seen any brand new 3 bedroom homes with garages from 110,000 lately? What about new 4 bedroom homes under 150,000? You will at Ole South!

For those wishing to live in Williamson County, we offer ALL BRICK homes from the low 200’s in Benevento East, with another location coming soon. Just around the corner is Meadowbrook and Cobblestone, offering a village of maintenance free town homes and traditional homes from the low 100’s.

The best values in the Greater Nashville area can now be found in Clarksville too! A new family moves in as fast as the homes are completed, so no TV spots there yet!

We’ll finish up all of the filming this week and hopefully have our new neighborhood spots running in several weeks. Until then, take time to visit our many new home neighborhoods today and see the beauty through your own eyes!

Find out why thousands of Tennesseans are proud to say:

Trey Lewis is a licensed Real Estate Broker in the State of Tennessee with Ole South Realty, 615.896.0019 direct 615.593.6340. Specializing in new homes in the Greater Nashville area to include Nashville, Murfreesboro, Smyrna, Clarksville, and Spring Hill, Tennessee